Banking in a World of Hyper-Personalization: Is banking so much different than ecommerce?

Christian Schultz

Financial services are changing rapidly. Over the coming years, banks will need to ensure their purpose reflects the expectations of their customers and keeps up with their evolving demands.

The issue for banks is two-fold. On the one hand, existing business models face disruption due to challenger and digital banks. On the other, consumers have become used to a certain level of usability, service and customisation which they simply don’t experience when banking – posing a major threat to existing business models. This expectation comes partly from the customer experience provided by retailers in the ecommerce sector.

When it comes to ecommerce, only the brands with the best customer experience thrive. This is largely due to hyper-personalization. But how can it bridge the gap between the worlds of financial services and ecommerce? And what are the specific benefits it can deliver to banks?

The ecommerce example

Amazon and Netflix have both implemented hyper-personalized customer journeys. Amazon, for example, actively creates personas from data collected from customers’ shopping baskets. If a customer, say, adds a selection of baby products to their basket, this will prompt Amazon to ask the customer the sex of their newborn, incentivising them to buy more by offering the chance to win a Prime subscription.¹ Similarly, Netflix uses customers’ viewing habits – to such a granular level as which parts of films they re-watch or skip – to offer film recommendations.

This approach has boosted revenues for both Amazon and Netflix. 35% and 60% of their sales respectively come from hyper-personalized recommendations.² By better tailoring their products and services to what customers need at a specific moment, with pinpoint accuracy, customers are more likely to buy. A lesson that can easily be learned by banks.

How can banks benefit from hyper-personalization?

As other industries are evolving when it comes to personalized offers to their clients and prospects, like in retail or generally in ecommerce, so customer expectations increase. According to the latest Deloitte report on the future of retail banking, 51%³ of customers expect that their bank will anticipate their needs and will make relevant suggestions prior to a direct contact. This is the moment when hyper-personalization comes into the play. Investing in hyper-personalization tools will help banks engage with consumers and deliver the right products at the right time.

There are three key reasons why hyper-personalization will bring considerable benefits to banks:

- Revenue growth by improved product and service positioning, providing relevant offerings at the right point in time in front of a customer.

- Cost reduction due to reduction in customer retention and acquisition costs but also because of automation throughout the sales process.

- Customer experience because of real-time adjustment of presented offerings and better fit to customer needs at a specific point in time.

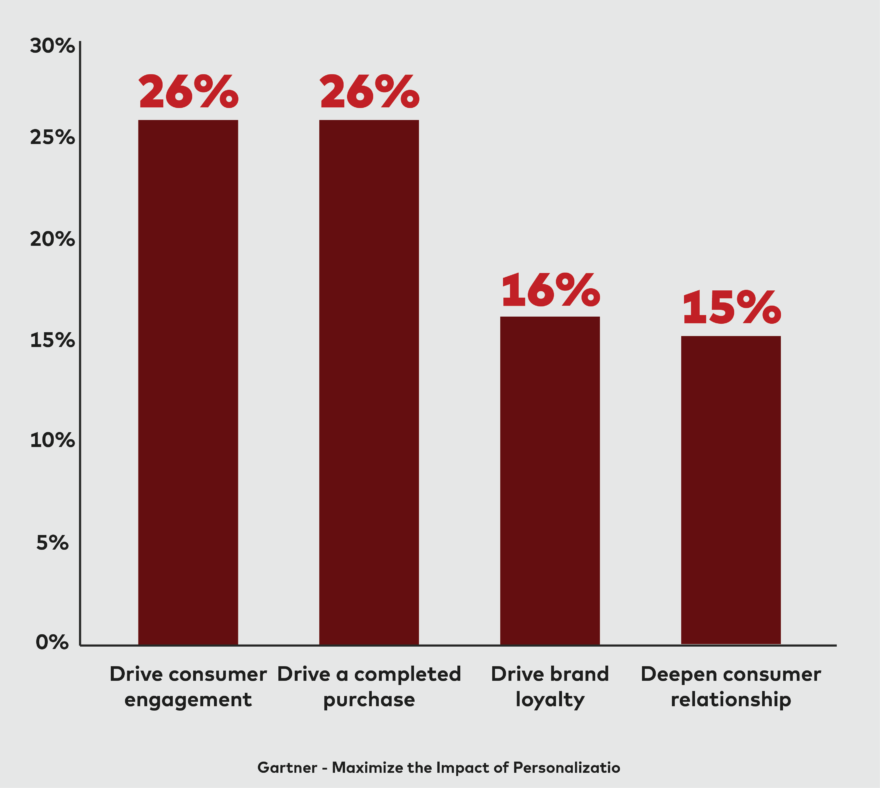

According to Gartner⁴, only 12% of consumers feel that brands are meeting their expectations right now when it comes to personalization. However, from the perspective of the brand, 16% have seen a greater commercial impact than if they hadn’t applied personalization.

With that in mind, there is still significant room for improvement in the finance sector. But what is key is that banks have plenty of space to differentiate themselves from their competition, with all the positives that brings.

Laying the foundations of hyper-personalization

Hyper-personalized banking starts with identifying customer needs. To cook up a solution, one ingredient is needed: data. Whether internal or supplied by a third party, data is at the heart of hyper-personalization and is essential to achieving any of the above benefits.

As a basis it is extremely important for banks to have a solid data layer and consolidated access to their customer and product data in place. This is so artificial intelligence (AI) can be used to analyse that data and recommend relevant products to specific customers in real-time.

As banks look to the future, new technologies like big data and AI are set to unlock unprecedented potential to improve services and bring institutions closer to customers.⁵

Banks need to place greater focus on new technologies relating to data and data consolidation to ensure they can keep up with customer demand in order to stay relevant, but also to increase their revenue share in a competitive market environment and manage their costs and customer retention. Therefore, it is a necessity to learn from other industries like eCommerce in order to deliver real-time, relevant interactions to survive in such a competitive marketplace.

Regulation sets banking apart from ecommerce, yet this is likely the largest point of difference. Otherwise, the potential is there in both industries, centring on the core principle of attracting customers to a product or service and then keeping them in the longer term.

Both financial services and ecommerce depend on being able to sell products and services, hence both face the same challenges in this digital age: creating journeys which are seamless, targeted and inspiring.

About the writer:

Christian Schultz is Business Development Director at Critical Software, responsible for banking, insurance and digital commerce. He has more than 15 years of cross-industry experience in the IT and technology environment, especially in transformational outsourcing projects and digital transformation initiatives.